Tokenomics

Token Allocation

With a total token supply of 1 billion, War of Coins’s distribution strategy is meticulously designed to foster a thriving ecosystem while ensuring equitable participation and sustainable growth. Here's a breakdown of how our tokens are allocated:

Ecosystem: 72%

Community: 3%

Early Users: 3%

Team: 12%

Investors: 10%

Kindly be aware that the tokenomics outlined below are still under development. As the launch of $WARC has yet to occur, the War of Coins team is actively seeking feedback and aiming to finalize the tokenomics before the launch date. War of Coins and $WARC are entirely independent entities and hold no affiliation with any other projects sharing similar names.

Token Rewards

Ecosystem Rewards

Action Mining: Rewards for Traders – every action can trigger a mining event such as purchasing options, connecting social media accounts, referring friends to the platform, being on the top of the leaderboard, and completing the trading streak to reward active participation from traders. Action mining will contribute to the goals of the platform and steer the ecosystem toward sustainable long-term success including platform growth, user retention, and community building.

Liquidity Mining: Rewards for Liquidity Providers per dividend cycle as indicated on each pool.

Community Rewards

Community Activities: Actions such as participating in community discussions, campaigns, and events, and contributing to platform improvements through feedback or bug reporting can also generate rewards for users.

War of Coins Revenue Model

War of Coins derives its revenue primarily from the operation of liquidity pools, where it acts as an option writer and facilitates the options trading within the War of Coins Arena.

Option writers generally face a higher risk than option buyers. The War of Coins’ pricing engine plays a pivotal role in mitigating this risk by dynamically adjusting margins in response to evolving market conditions and risk factors. By continuously monitoring market dynamics, including volatility, liquidity, and asset prices, the engine strives to maintain a fair and stable trading environment for all participants.

Revenue Distribution

LP Growth: 20% Revenue allocated for LP growth will help expand the liquidity pools within the War of Coins ecosystem. By increasing liquidity, the platform can improve trading efficiency, reduce slippage, and enhance the overall user experience on War of Coins Arena.

LP Cash Dividends: 20% LP cash dividends represent a direct return on investment for liquidity providers within the ecosystem. These dividends are distributed to participants who contribute assets to the liquidity pools, rewarding them for their role in facilitating trading activities and maintaining market liquidity.

Legion Trading Profit Bonuses: 15% At the end of each dividend cycle, a percentage of the profits made from the liquidity pool is set aside and added to the trading profit bonus pool. The trading profit bonus pool is then distributed based on the trading volume of your Legionaries relative to the War of Coins Arena trading volume, and rewards are allocated according to your referral network size and positions.

dApp Operations: 15% This portion is allocated towards the ongoing development, maintenance, and improvement of the War of Coins ecosystem. These funds support the research, design, and implementation of new features, as well as the optimization of existing dApps to enhance user functionality and experience.

Treasury: 15% A critical aspect of the War of Coins ecosystem is its commitment to ensuring token price stability and facilitating ongoing token operations. To achieve this, 15% of LP revenue generated from LP operations in each dividend cycle is allocated for specific purposes aimed at sustaining the token's value and supporting its utility within the ecosystem.

The primary application of this reserved fund is to execute token buyback programs which involve the purchase of circulating tokens from the open market using the reserved funds. The treasury also serves as a resource to replenish liquidity pools in the event of substantial losses or emergencies.

Token Stakers: 15% Revenue allocated for token stakers is distributed among users who stake their tokens within the ecosystem. Staking tokens enables users to earn a share of the revenue generated from liquidity pool operations.

Token Rights and Benefits

Revenue Sharing

15% of the total revenue generated by the liquidity pools is distributed among token stakers in each dividend cycle. Staking tokens within the War of Coins ecosystem opens up avenues for passive income for stakers. By staking tokens, users gain access to a revenue-sharing mechanism tied directly to the liquidity pools (LP) operation on War of Coins Moneta. This revenue-sharing feature is a cornerstone of the platform's commitment to rewarding active participation.

DAO Governance

Stakers not only benefit from the platform's growth and success but also play a direct role in shaping its future trajectory: proposing and voting power in the platform's Decentralized Autonomous Organization (DAO) governance. This governance framework empowers token holders to actively participate in decision-making processes, influencing the direction and evolution of the platform in a democratic manner.

The amount of voting power granted to staked tokens is determined by two key factors: the length of time the tokens have been staked and the quantity of tokens staked. This means that the longer tokens are staked and the greater the quantity staked, the higher the voting power wielded by the staker within the DAO governance system.

Under the DAO framework, the platform's policies, protocols, treasury management, and future developments are subject to governance.

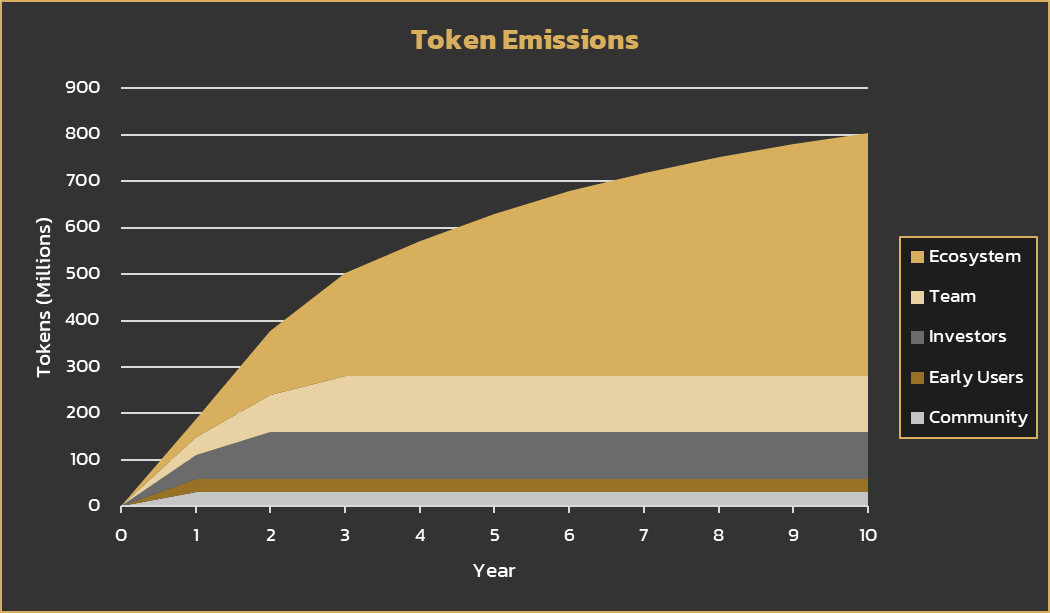

Token Release Schedule

Initial Supply

A total of 33% of the token supply is allocated for distribution, with vesting schedules spanning various durations ranging from 12 to 36 months.

Community and Early Users: 12 months By vesting tokens for community members and early users over a one-year period, the project incentivizes their ongoing participation and engagement. This ensures that these key stakeholders remain committed to the project's success over the long term.

Investors: 24 months Investors' tokens are vested over a longer period. This aligns the interests of investors with the long-term success of the project. It discourages short-term speculation and encourages investors to support the project's growth and sustainability.

Team: 36 months The longest vesting period for team members ensures that team members are committed to the project for an extended period, fostering stability and continuity in project development. It also mitigates the risk of team members selling off their tokens quickly, which could destabilize the project.

Ecosystem Reward Schedule

There's a capped allocation per epoch based on trading volume. These epochs have a duration of one year each. During the initial two years, the maximum allocation stands at 10% and 15% of ecosystem tokens respectively. Subsequently, starting from the third year, the allocation diminishes by a factor of 1.2x with each successive epoch.

Last updated