War of Coins Moneta

The liquidity pool within War of Coins serves as a robust automated option writer, seamlessly providing liquidity to option buyers. Moneta accommodates multiple pools featuring different coins, allowing traders to make precise selections tailored to their preferences.

Liquidity Pool Units

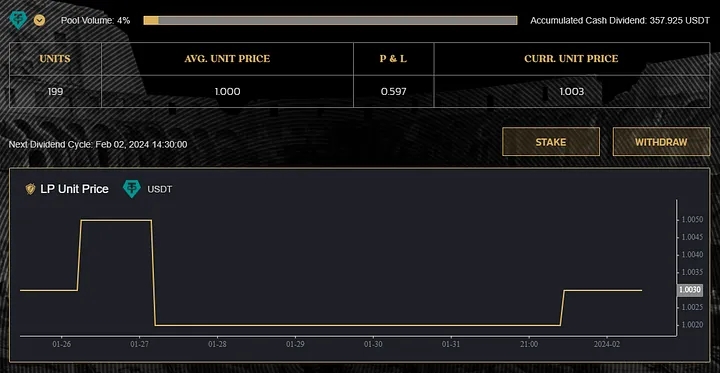

Shares within the liquidity pool are denoted as LP Units. These units are assigned a specific value during the pool’s initiation, and their subsequent prices are subject to fluctuations based on the profit and loss experienced throughout the pool’s operations.

Deposit/Withdrawal

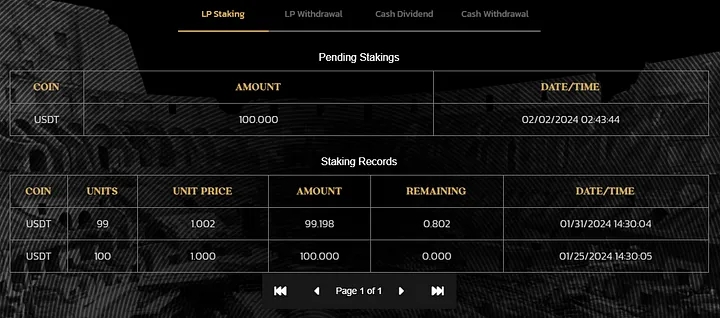

Moneta ensures a fair and transparent process for deposit and withdrawal requests by holding them in a pending state until the next dividend cycle. This approach safeguards the integrity of the LP Unit price, benefiting both existing and new LP participants.

Deposit: Upon acceptance of a deposit request, the specified amount is seamlessly transferred to the pool contract. Any remaining funds, after processing during the subsequent dividend, find their way back to the LP via the system vault contract.

Withdrawal: For withdrawal requests, the actual amount is deposited into the system vault contract, facilitating a smooth transfer-out process by the LP. This meticulous approach guarantees a seamless and equitable experience for LP providers.

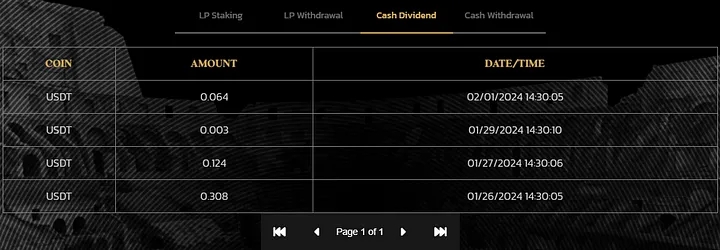

Dividend Cycle

Moneta’s pool operations follow a predefined dividend cycle as indicated on each pool. During each dividend distribution, the pool’s revenue is allocated among liquidity providers, membership system rewards, and operational costs.

War of Coins employs a sophisticated risk management strategy to guarantee the payout of our users’ positions. The allocated fund for each session is divided into several slots, each corresponding to various maximum payout levels, such as 100, 50, 20, 10, 5, 2, and 1 times. The value of each slot is proportional to the maximum payout level, with the highest payout slots allocated more funds. For example, if the 100 times slot contains 1 million USDT, the 50 slot should contain 0.5 million, and the 2 slot should contain 0.02 million. Each slot can accept orders up to a total amount of 10K USDT.

The price ladder tranche system begins each session with the 100 times slot active, and once the total purchase amount for that slot is exhausted, the system will switch to the next lower payout slot, corresponding to a new maximum payout level. For instance, when the 100 times slot is depleted, the system will move to the 50 slot, and the maximum payout will be reduced to 50 times for the new purchase.

If an option purchase surpasses the liquidity available in a segment, it moves to the next available segment.

In each session, there are maximum allowed single and total purchase amounts that apply to each user, which can be configured depending on the session’s fund size. Our system continuously monitors extreme volatility and sudden price movements, which may indicate unusual price movements from the engine model’s perspective. In such cases, purchases will be halted to protect both users and liquidity providers. Existing options contracts will remain active until maturity; however, the system will suspend new option purchases until it deems the volatile event to have concluded.

Through our robust risk management policies, War of Coins ensures that all purchases are backed by the liquidity pool, providing a safe and secure trading environment for our users.

Last updated